Performance Bonds

Find Your Performance Bonds:

Filter Bonds

Types of Performance Bonds

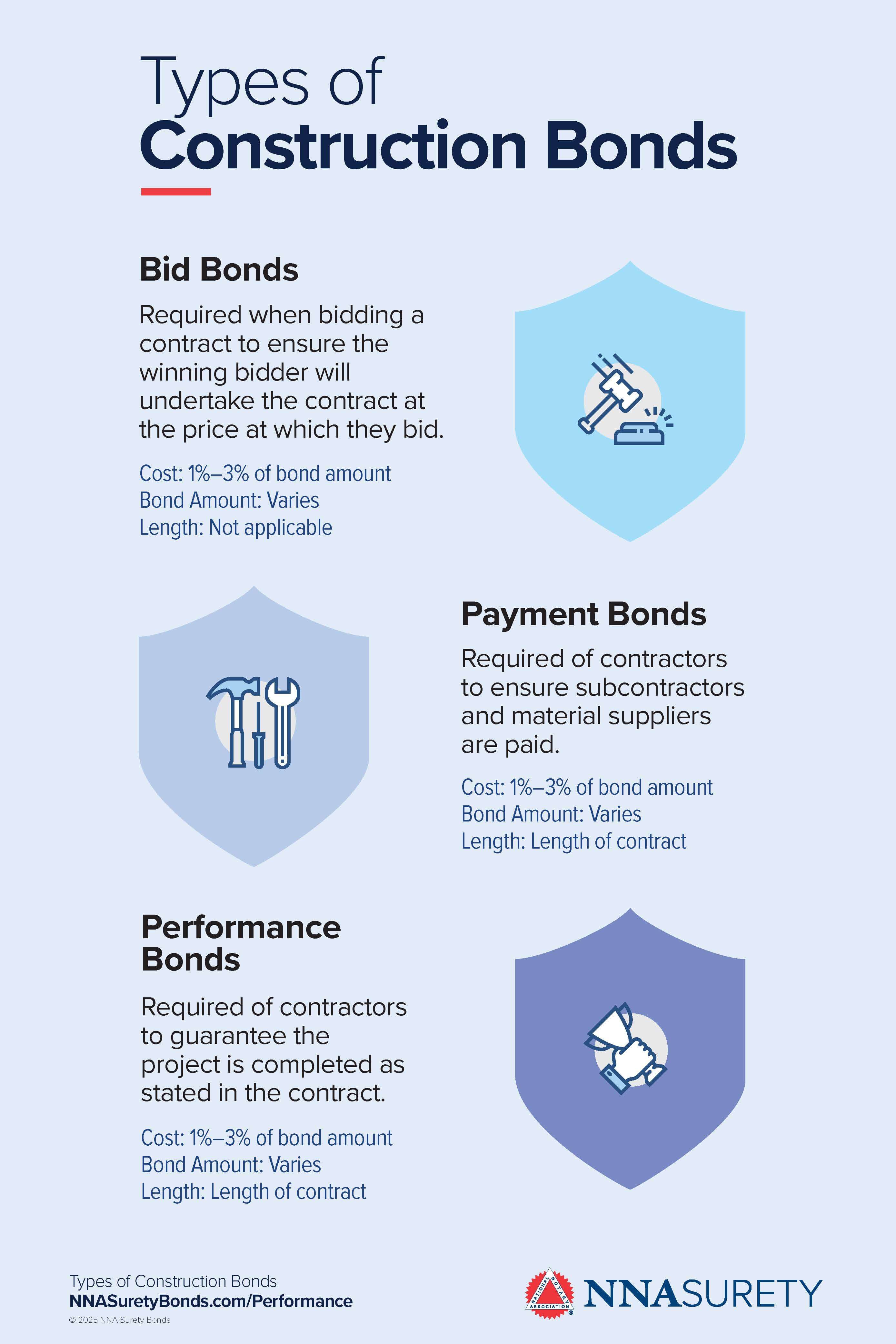

Below are the most common types of contract bonds in the construction industry.

- Bid Bonds: Often required when bidding on projects to assure the project owner you will enter into a contract and purchase additional bonds if awarded.

- Payment Bonds: Guarantees everyone involved in the construction project, including subcontractors, laborers, and suppliers, are compensated.

- Performance Bonds: Assures project owners' contractual obligations will be met and according to state regulations and standards.

- Non-Construction Performance Bond: Guarantees contracts unrelated to a building or construction job. Examples of non-construction performance bonds include janitorial services and landscape maintenance.

How much does a construction bond cost?

While exact costs will differ from contract to contract, a construction bond typically can cost between 1% to 5% of the contractual amount. Other factors, however, can influence the overall cost of the bond such as the principal's overall credit rating and financial strength which may result in a lower bond rate.

In cases where the project and contract are quite large, the use of a “blended rate” to calculate the overall cost of the performance bond could occur.

Construction Bond FAQs

How long does a construction bond last?

Typically, the term limit for claiming a construction bond is determined within the bond contract itself. That said, most performance bonds have a duration of twelve months but can (usually) be extended or renewed.

Who is the obligee on a construction bond?

An obligee is the party that receives financial compensation when a valid claim is filed against a bond. In the case of a construction bond, the obligee would be project owner.

What is the difference between a performance bond and a bid bond?

Performance bonds and bid bonds differ in two key ways:

Cost: Bid bonds are generally issued by a surety company to contractors at no cost, while a Performance bond is paid by the contractor.

Protections: Both performance and bid bonds are claimed by the project contractor. However, they provide different financial protections. As outlined above, performance bonds protect the project owner in case that a contractor fails to perform the job. On the other hand, a bid bond protects the contractor from changing terms and conditions.

The Simple Bonding Process

Performance Bond Resources

People who work in a variety of industries—including immigration consultants, tax preparers, contractor services, and many others—need to get bonded. But not all bonds are created equal. This guide covers the most important things you need to know about getting the right surety bond to meet your business needs and what that bond really means.

Learn MoreWhen performing a contract, most commonly in public works projects, the project owner may request that the general or subcontractor post and maintain a performance and payment bond to guarantee the performance of work under the contract and payment to all labor and vendors. If working on bonded projects is something you’re interested in, you may want to consider getting pre-approved for a construction bond line.

Learn More